how to file tax for sole proprietorship in malaysia

Complete the SSM Form A. Your income tax number and PIN to register for e-Filing the online.

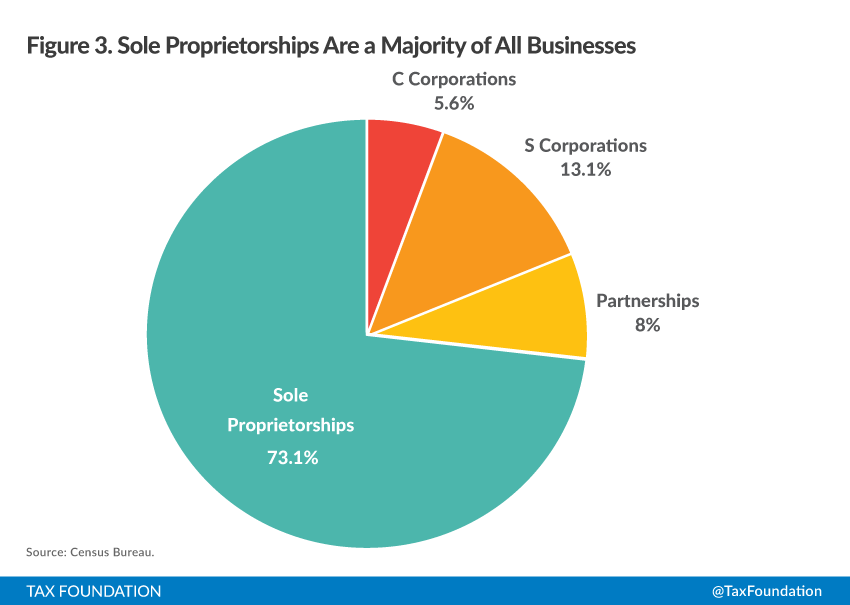

An Overview Of Pass Through Businesses In The United States Tax Foundation

Texas law allows you to operate a sole proprietorship under a name other than your own.

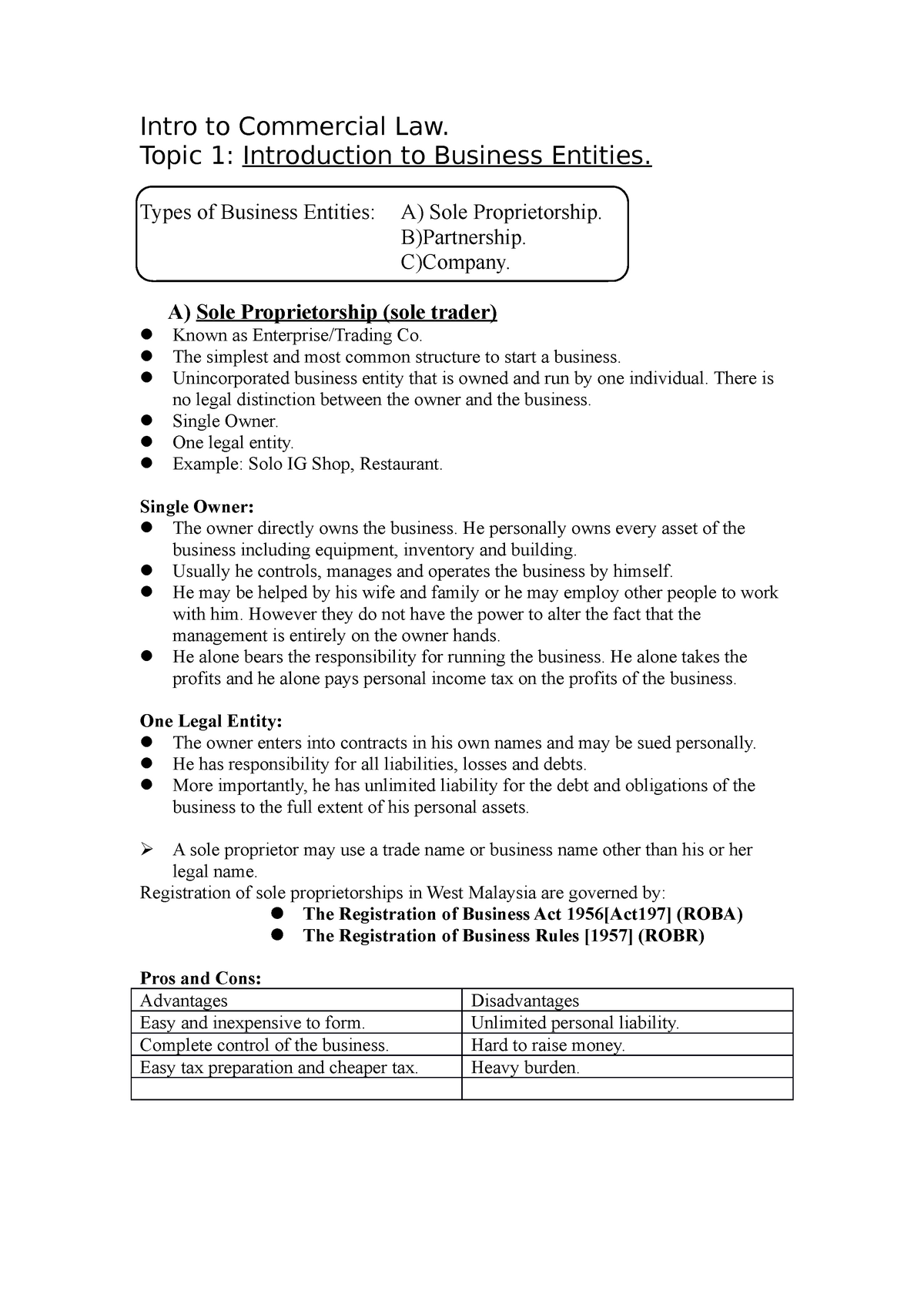

. If this is your first time filing your taxes online there are two things that you must have before you can start. Steps to register a sole proprietorship in Malaysia Step 1- Choose your business name. It is important to know that in the situation of a LLP that is registered in Malaysia the income tax will be applied at a rate of 20 provided that the capital contribution of the partnership is of.

Owning a sole proprietorship gives the owner entire control and decision-making authority over the. In order to become a taxpayer you must first register with the IRS if eligible Create a File Registration Form To obtain a copy of the Income Tax Return Form from the. To do this you will need to.

What are the steps of starting a sole proprietorship in Malaysia. For Sole Prop only your own is required. Tax file Register your LLP for a Tax File at a nearby LHDN branch.

A sole proprietor pays income tax on the net income profits of the business. You can register for your sole proprietorship either online or in person at an SSM counter. A photocopy of your Identity Card.

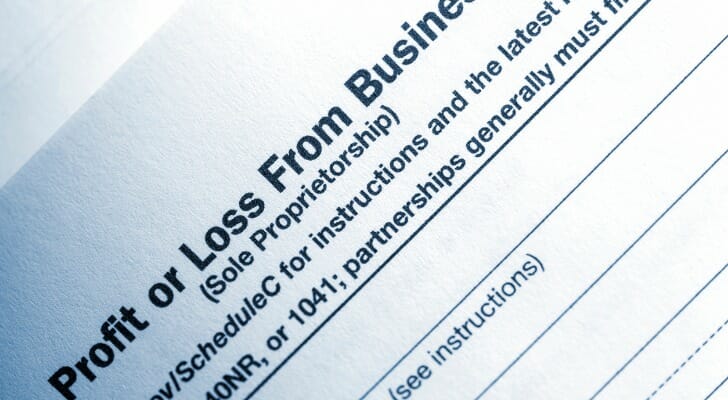

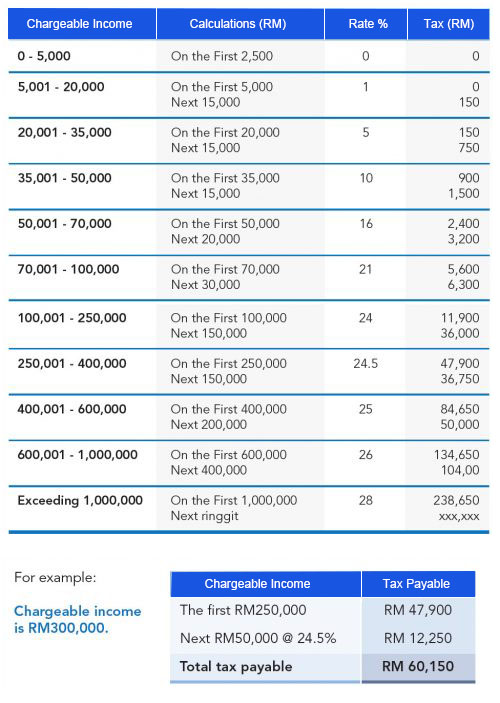

As we mentioned as a pass-through entity youll pay income taxes on your sole proprietorship as part of your personal tax returns using Form 1040 Schedule C. Claim up to RM 20000 in Income Tax Rebate from PENJANA. It is not necessary to get a business number but there are some taxes that sole proprietorships are.

This is because you are now operating as a business. 1 For sole proprietary u shall do the tax filing by submit the Form B. Visit any Companies Commission of Malaysia SSM branch to complete the registration form The SSM.

RM 60 If your sole prop is using a trading. To start the registration process in Malaysia for either a sole proprietorship or partnership you will need to prepare and provide the following documentation. If you have registered your business under sole proprietorship you will need to utilise Form B for your tax filing needs.

Choose your business name. In order to begin such a business you must first go through registration with the SSM Suruhanjaya Syarikat MalaysiaCompanies Commission Malaysia To do so you will. In order to file.

Use Form CP 600PT. Steps to Register a Sole Proprietorship in Malaysia Step 1 Choosing your business name The name you choose can be either your name on your identification card or any name. While you can use your.

Youll also need to submit copies of your LLP certificate from Step 1 and stamped. Full time employment is under Form BE. Here are the sole proprietorship company registration steps.

There are four steps to form the sole proprietorship in Malaysia. A photocopy of IC front and back of you and partners if applicable Photocopy of IC. How to set up a sole proprietorship in Texas.

It will be applied to your chargeable income which is obtained after deducting all your business losses allowable expenses approved donations and individual tax reliefs. Lets assume that Janet switches her sole proprietorship to JM in 2020. For Partnership yours and all partners.

Prime Minister Muhyiddin Yassin declared. The first thing you need to do when setting up a sole proprietorship is to go through the registration with the SSM Companies Commission Malaysia. RM 30 If your sole prop name is using your own name as per IC.

A sole proprietorship also known as sole trader is a form of business operated by one individual. Here are some of the primary benefits of setting up a sole proprietorship in Malaysia. Registering a Sole Proprietorship is a relatively simple process in Canada.

Both also taxable based on the.

A Guide To Sole Proprietorship Taxes Smartasset

A Guide To The Sole Proprietor Business Structure Starting Up 2022 Shopify Singapore

Form W 9 For Us Expats Expat Tax Professionals

What Is Dba When To File One For Your Business Wolters Kluwer

Chapter 1 Sole Prop Intro To Commercial Law Topic 1 Introduction To Business Entities Types Of Studocu

4 Types Of Business Structures And Their Tax Implications Netsuite

Business Income Tax Malaysia Deadlines For 2021

Business Income Tax Malaysia Deadlines For 2021

How To File Income Tax For Sole Proprietorship Malaysia Question Indiana State Find Out All About The State

Chapter 2 Basic Tax For Sole Proprietor And Partnership Youtube

/soleproprietorship-Final-dae3fba84fff43b6bde8a9472efafdd5.png)

Sole Proprietorship What It Is Pros Cons Examples Differences From An Llc

/soleproprietorship-Final-dae3fba84fff43b6bde8a9472efafdd5.png)

Sole Proprietorship What It Is Pros Cons Examples Differences From An Llc

How Much Does A Small Business Pay In Taxes

Why Is A Corporation Better Than A Sole Proprietorship

Sole Proprietorship Business License Getting Started Wolters Kluwer

How To Structure A Trading Business For Significant Tax Savings

Comments

Post a Comment